Financing Farms, Homes, and Land in Florida

We know Ag.

You want a lender who understands your needs, offers a great interest rate, and provides a local and personable lending partner right in your own community. Welcome to Farm Credit of Florida.

Ready to Get a Loan?

“Farm Credit as the name says everything. They are a bank that supports farmers so I prefer working with Farm Credit than any other banks. We get our support from Farm Credit.”

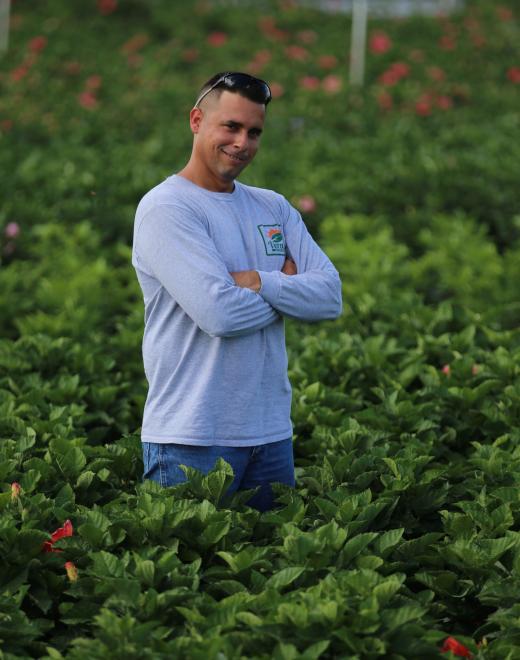

Ismel Vera

“Farm Credit as the name says everything. They are a bank that supports farmers so I prefer working with Farm Credit than any other banks. We get our support from Farm Credit.”

It's a story of the pursuit of life, liberty and happiness: fifteen years ago the Vera family, of Vera's nursery, arrived from Cuba, running away from a regimen that had no room for freedom of speech, liberty, and much less the ability of someone to own a business. Leaving behind everything except a dream, the "American Dream", they brought with them hard working ethics that later turned out to be the very key to their success.

Two years after their arrival the family business was born. The family worked seven days a week, often from 7 in the morning until 5 at night, on only two acres of land. They named their business Vera's Nursery and continued to work hard, never taking a day off, fueled by their passion to grow plants.

"I like the nursery business because you are working with nature," says Ismel Vera. "You can actually see the change in the plants. You take a seed and grow it into one big palm in a 25 gallon container. Growing plants, that's my passion."

Throughout his years of growing, Ismel has learned that what makes him truly successful in the nursery business is this love for what he does. "In this business we learned that when you do what you like to do you see different results in the end. You have to select the business that you are passionate about. Like in my situation, I like the plant business so I'm here in the plant business."

Today, Vera's Nursery consists of more than 100 acres growing fifty different types of palms, shrubs, topiaries, and hibiscus; however, Ismel is not done yet. "I want to try to grow more and get bigger and bigger", he says.

One key to this growth has been the help of Farm Credit of Florida. Ismel says, "Farm Credit has helped me a lot in this business. We want to grow more and more and every nursery that wants to grow needs support from one bank- and we select Farm Credit and for me that is the best bank for my business."

"Farm Credit as the name says everything. They are a bank that supports farmers so I prefer working with Farm Credit than any other banks. We get our support from Farm Credit."

“We are all on the same page," Bolin said. “We are all working together and doing all we can to keep doing what we're doing.”

Millie Carlton Bolin

“We are all on the same page," Bolin said. “We are all working together and doing all we can to keep doing what we're doing.”

The Carlton family has ranches and groves across three south Florida counties. Bolin works with her father and brother every day to continue the family tradition of raising cattle in southwest Florida. For Bolin, working on the same land her family settled on centuries ago brings with it great pride, along with great responsibility.

"We take our jobs very seriously," Bolin said. "We know how lucky we are that the good Lord chose us to be the stewards of this land and it is a responsibility that we do not take lightly at all."

The responsibility to care for the land is a value that many in the agricultural industry share, including Farm Credit of Florida.

"Working with Farm Credit has been nothing but a pleasure," Bolin said. "Farmers and ranchers have so much they have to deal with on a daily basis that it is a breath of fresh air to work with someone like Farm Credit that understands what we do."

Although sometimes the agricultural industry can be tough, Bolin knows that no matter what happens she can find an ally in her local Farm Credit branch.

"As long as we act in good faith, Farm Credit is always there for us," Bolin said.

Like everyone involved in agriculture, Bolin feels the pressure facing farmers and ranchers to feed the growing world, all while battling urbanization and the day to day challenges of operating an agricultural business. While balancing life with running a business can be stressful at times, Bolin finds relaxation every time she drives by the pasture on the way home.

"It is so rewarding to me to ride through the pasture and look at the new babies and know that we had a part in that," Bolin said. "Knowing that we planned that is a special feeling."

For those days that prove to be harder than others, Bolin saddles up her horse and emerges herself in what she loves.

"There is no greater relaxation than riding out and checking the cows after a long day at the office," Bolin said. "Just being out there admiring God's beauty and thanking Him for allowing us to be a steward of this land makes it all worth it to me."

In the case of Hurricane Matthew and now Irma, the board did not need to provide any direction. It is already ingrained in the culture of Farm Credit that the staff and the employees care about their borrowers.

John R. Newbold III

In the case of Hurricane Matthew and now Irma, the board did not need to provide any direction. It is already ingrained in the culture of Farm Credit that the staff and the employees care about their borrowers.

On September 10, 2017 Hurricane Irma, the most powerful storm to hit Florida in over a decade, made landfall in Marco Island, Florida before moving up the center of the state, leaving a path of destruction in her wake. For farmers in Northeast Florida, Irma brought hurricane force winds and torrential rain less than one year after Hurricane Matthew skirted Florida’s Northeast Coast as a Category 4 hurricane.

For the Newbold family, Hurricane Irma seemed like déjà vu. As growers of cut foliage under shade cloth, any wind event can bring devastation to the crop and cause major damage to growing structures, as was the case with Hurricane Matthew, and now again with Hurricane Irma.

While most other businesses would consider giving up after facing two devastating storms in as many years, John Newbold has taken a different point of view.

“I am encouraged by the future,” John Newbold, owner of Forest Groves, Inc., said. “Less than a year ago we had virtually the same issue. And last time I wasn’t sure we were going to make it.”

In preparation for the storm and in beginning the rebuilding process, Newbold believes that the experiences from last year helped him and his family better prepare for the storm and rebuild faster than they ever have before. Newbold also points to Farm Credit for being instrumental in the rebuilding process since they were there before, during and after the storm.

“Last year, through the help of Farm Credit, our employees and our local industry, we made it through the storm. Now that we are looking at a similar catastrophe, we can look back and say ‘were going to make it’.”

For Newbold, Farm Credit’s response began before Hurricane Irma had completely passed.

“The first call I received after the storm was from Farm Credit of Florida CEO Greg Cunningham asking about my family’s wellbeing and that meant a lot to me,” Newbold said. “I’ve done business with several other banks and you don’t get that kind of attention from them. Farm Credit cared for us, and that’s valuable to me.”

As a cut foliage farmer, Newbold makes up one of the smallest portions of the Farm Credit loan portfolio. This is why he was shocked by the response he received after the storm.

As a cut foliage farmer, Newbold makes up one of the smallest portions of the Farm Credit loan portfolio. This is why he was shocked by the response he received after the storm.

“I am in the cut foliage business, and I am sure we are one of the smallest fish in the Farm Credit pond,” Newbold said. “I would think that Greg would be calling the guy with the biggest loan first, but he had access to me, he reached out and it meant a lot to me, they care about the entire portfolio, whether you are a big guy or a little guy, and that’s meaningful.”

Farm Credit of Florida’s storm response began with the Board of Directors, where Newbold serves as the District 4 representative.

“Storm Preparedness is a big topic of conversation at board meetings, and it’s a big deal,” Newbold said. “In the case of Hurricane Matthew and now Irma, the board did not need to provide any direction. It is already ingrained in the culture of Farm Credit that the staff and the employees care about their borrowers.”

Farm Credit of Florida’s hurricane response plan includes donations to areas of need, volunteering in the local community, and most importantly providing excellent service to their customers before, during and after the storm.

“I would be surprised if Farm Credit members haven’t been contacted already by their lenders or their loan officer and been offered help,” Newbold said. “And if anyone needs help I urge them to reach out to the Farm Credit staff because that help is there.”

Overall, Newbold takes a positive look on the future of his farm after the storm.

“We are going to rely on all the same things we did last time to make it better, but I really feel happy about the prospects for our business and the cut foliage industry as a whole. It’s a tough day, but there is a brighter one on the horizon.”

“Farm Credit has done whatever was necessary to make sure they took care of the customer. It means a lot to producers like me.”

Jacob Larson

“Farm Credit has done whatever was necessary to make sure they took care of the customer. It means a lot to producers like me.”

For Jacob Larson, the cattle industry is just as much about family as it is about business.

"I am a third-generation dairyman and a second-generation beef cow-calf producer," Larson said. "My family and I raise beef cattle and operate a dairy in Okeechobee, Florida."

Larson values that his occupation comes with a special connection to the land and to nature. He spends a majority of his time working on his family's cattle operation and advocating for the agricultural industry through Florida Farm Bureau and the Florida Cattleman's Association.

After growing up helping his father and grandfather on the family farm, Larson started his own operation with the help of Farm Credit.

"I got my first loan from Farm Credit when I was 18 years old. I knew there might have been better rates out there but I also knew it was important to build a relationship," Larson said.

What drew Larson to Farm Credit was the expertise in agricultural lending that Farm Credit brings to the table.

"One of Farm Credit's most recent advertisements features the tagline "We are Ag" and that's so true," Larson said. "Farm Credit specializes in farm loans, and they are experts at specialized loans such as cattle. They know cattle."

Farm Credit's reputation in the industry also gave Larson piece of mind. He felt confident doing business with a lender that cares about their customers.

"I know in instances where things have gotten tight, Farm Credit has been there for the producers and has taken the side of the rancher," Larson said. "They have done whatever was necessary to make sure they took care of the customer. It means a lot to producers like me."

Larson values doing business with a company that makes him feel like family.

"Farm Credit has just been like family to me. It's been real easy to deal with loan officers and staff; they've always treated me like family. It means so much when you walk into a branch and they know you by name. It has been very easy for me to deal with Farm Credit."

It has also been very easy for Larson to get up and go to work every morning.

"I like getting up before the sun does," Larson said. "If I can be out on a horse in the woods and watch the sun come up I feel really close to nature, and to God. It is amazing what God put us on this earth to be stewards of and to enjoy."

Beyond being close to nature, Larson enjoys being close with his family.

"I've got three young kids," Larson said. "They like being involved in the cattle industry. They are a part of our farm. Whether it is working on our farm or with their 4H projects, they get a lot of exposure to agriculture, which is good."

Larson finds comfort in the fact that his children are involved in the family operation and they look forward to continuing the operation into the future. Until then, Larson continues to spend time with his family and raise cattle and produce milk for the growing world.

“I’ve always respected the hard work involved with agriculture, and I am thankful that Farm Credit was able to make my childhood dream of being a farmer come true.”

Dr. Fred Gainous

“I’ve always respected the hard work involved with agriculture, and I am thankful that Farm Credit was able to make my childhood dream of being a farmer come true.”

As a young boy, Fred Gainous always dreamed of becoming a farmer. Nearly 30 years later after a successful career in education, his dream of becoming a farmer came true.

Born and raised in Tallahassee, Florida, Gainous did not grow up on a farm. However, he always found the farm lifestyle intriguing. After high school, Gainous decided to study at Florida Agricultural and Mechanical University, earning his bachelor’s degree in agriculture. Gainous then went on to complete his master’s degree in agriculture and his doctorate of education from the University of Florida.

After graduation, Dr. Gainous enjoyed a long career in higher education, eventually rising to become the president of Florida A&M University.

A Dream on Hold

Although Dr. Gainous enjoyed every minute of his career in education, he still had the same dream in his head that he had as a young boy; to become a farmer. While most are ready to enjoy their retirement on a golf course or in a beach house, Dr. Gainous was ready to retire so he could get to work.

“When it comes to owning a farm, people told me that there were only two ways to be successful,” Gainous said. “You have to be born into it, or marry into it. Farm Credit gave me a third option.”

Before he could buy a farm, Gainous’s first challenge was figuring out what he could grow and how he could be profitable. After some deliberation, he and his wife decided on Coastal Bermuda hay.

“What drew me to a hay farm was the ability to watch something grow and multiply every day,” Gainous said. “My wife and I agreed that we could grow quality hay and still stay profitable, and the sunsets over a hay field are simply spectacular.”

Back to School

After a career in education, Dr. Gainous was not afraid to go back to school.

“After we decided on growing Coastal hay, I realized that I had no idea how to actually grow hay and run a farm, so I reached out to a farmer in south Georgia, and he agreed to let me be his apprentice for a season,” Gainous said.

After his apprenticeship, Gainous and his wife Beverly searched throughout north Florida for the right farm, eventually settling on 80 acres just outside of Live Oak. “When we found the farm we wanted to buy, we said to ourselves, ‘Ok, how do we do this without spending all of our life savings?’ that is where Farm Credit came in,” Gainous said. “Farm Credit rescued our dream of Farm Ownership.”

A Dream Rescued

While most people his age are booking their next tee time, Gainous is scheduling fertilizer deliveries and spraying for army worms. He relies heavily on the help of his friends and neighbors in the community, many of whom he met at the annual Live Oak customer appreciation dinner.

When asked to sum up what he has learned from his farm experiences so far, Gainous, without hesitation, replies “Farming will teach you how to pray.”

“I’ve always respected the hard work involved with agriculture, and I am thankful that Farm Credit was able to make my childhood dream of being a farmer come true.”

“I enjoy knowing I am part of a long legacy, and Farm Credit has helped me ensure the legacy carries on.”

Alex Johns

“I enjoy knowing I am part of a long legacy, and Farm Credit has helped me ensure the legacy carries on.”

The streets of Brighton are now paved with asphalt and used frequently by gamblers and visitors alike. However, it was not always this way.

Located between Lake Placid and Okeechobee, the Brighton Seminole Indian Reservation spans 36,000 acres on the western side of Lake Okeechobee. This serves as the base of the Seminole Tribe’s cattle operation, the 12th largest in the nation.

The cattle industry in the U.S started in Florida in 1521, and the Seminole Tribe was involved from the very beginning. With over 500 years of experience, the Seminole Tribe has faced many challenges but continued to persevere and began to expand their cattle operations in the late 20th century. The Seminole Tribe currently has over 12,000 head of cattle making them the fourth largest cattle producer in the state of Florida.

"I feel like cattle are part of my DNA. It’s in my blood. It’s what we do and raising cattle is an important part of our history," Alex Johns, a proud Seminole cattle rancher, said.

For Alex Johns, raising cattle has always been a part of his lifestyle. He currently serves as the Natural Resource Director for the Seminole Tribe of Florida, where he oversees the ranching operations and marketing efforts of Seminole Pride Beef. On top of managing the natural resources of the Tribe, Johns has his own herd of cattle.

Although Johns still uses some of the traditional methods of raising cattle, the technological advancements that have been made recently in the Cattle industry have helped him become more productive.

"There is a lot of difference in how we raise the cattle now, with the biggest being technology. From the improved pharmaceuticals we can use today to animal tracking and handling procedures, we have completely modernized the herd," Johns said.

His cattle are still worked by horseback, with some of the horses used being decedents of the original Seminole Marshtackies, more commonly known today as Florida Cracker horses.

Beyond the nostalgia of riding through the herd on horseback, the cattle industry can be a tough business. The Seminole Tribe lost most of their cattle in the 1800s and were not able to re-establish a herd until the 1930s. Much like the Tribe as a whole, Johns has individually experienced his fair share of hardships in the industry as well. "The cattle industry is a hard business. It’s a hard way to make a living. We do a lot of work for a little bit of money. The hard work we put into is just because we appreciate the product we are producing. We know that we are producing a wholesome, safe product and we are feeding the world off the sweat from our brow," Johns said.

Regardless of the hardships that go along with raising cattle, Johns continues to expand his personal cattle operation with the mission of feeding the growing world. When he needed an agricultural lender to partner with, he chose Farm Credit of Florida.

"Farm Credit understands agriculture. It’s simple for me to go in and talk with a Farm Credit representative and present my business plan where they have an understanding of what I am trying to accomplish. If I go to a traditional lender it’s an education process."

On top being easier to work with, Johns feels at home when dealing with Farm Credit.

"Farm Credit is like dealing with family. It is easy to explain your position and situation and they understand you. They get it. It’s just simpler to work with Farm Credit."

Johns has recently teamed up with Florida Cattle Ranchers, LLC. to market his cattle as locally sourced beef to restaurants and grocery stores throughout Florida.

"I believe in producing local food and I know that local Florida ranchers produce a good product. I was able to bring some of my experience from marketing Seminole Pride beef to the table and we look forward to continuing to grow our market share," Johns said.

Beyond working hard to provide beef to the worlds growing markets, Johns likes to invest his time in the younger generations, encouraging the youth of the Tribe to get involved in 4-H and FFA programs and continues to be a leader in the Florida Cattle Industry.

Great Service for Life

We understand the importance of “locally grown” and that is why when you partner with Farm Credit of Florida we keep and service your loan locally instead of selling it off to another group. When you partner with us, you gain a local financing expert to help you achieve your goals.

It Pays to Be a Member

As a member-owned co-op, we put our profits in your pockets.

Find a Career You Love

Why have a "job" when you can have a successful career with the Farm Credit of Florida Family? Make a change and make a difference.

Contact Us

Contact one of our lending specialists to find out how to get the financing you need.